Individual Investors

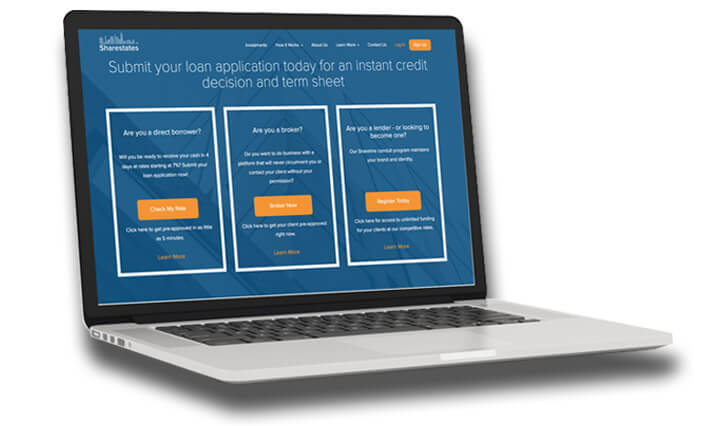

Individual accredited investors can access a large marketplace of institutional quality mortgage loans that have been sourced and underwritten by industry leaders. As an individual investor, you'll be participating side-by-side with large institutions in the same quality product. You can even set up auto-invest to manage your investment strategy - delivering you peace of mind that you're never missing an opportunity. Our investors earned over a 10% annualized return last year - get started today!

Join SharestatesInstitutional Investors

Sharestates offers both a fractional and whole loan program for institutional investors. We’re working with some of the country’s largest institutions and banks – with target investments north of $5 Billion. Whether you have a levered or unlevered strategy, rest assured that large financial institutions such as Goldman Sachs, Deutsche Bank & many others have vetted and approved our platform. We work closely with our institutional partners to find an investment mix that’s built just for them – allowing you to focus on the bigger picture – capital raising and investor management! Join us today to find out how you can become part of our exclusive whole loan buyer platform.

Join SharestatesNPL Investors

While Sharestates doesn’t have many Non-Performing Loans relative to our production volume, we do of course experience defaults from time to time. We take a very hands-on approach to working on these files and sometimes will sell these loans to return principal to our investors. If you’re interested in joining our exclusive NPL Auction House, register today to learn more. Please note the program is not available to everyone as we take a great degree of care in vetting our NPL buyers.

Join SharestatesWhat we do

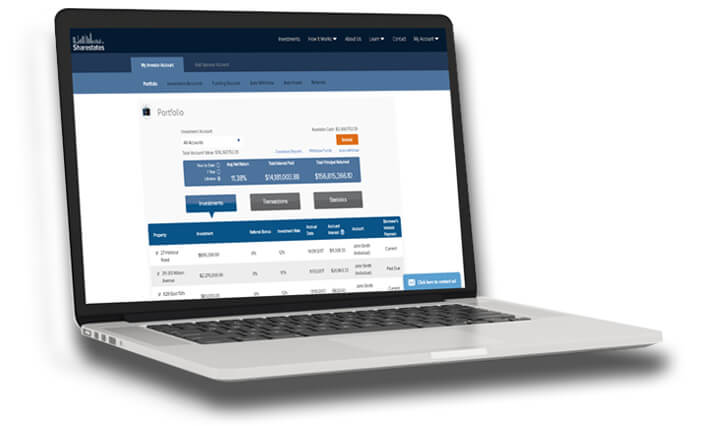

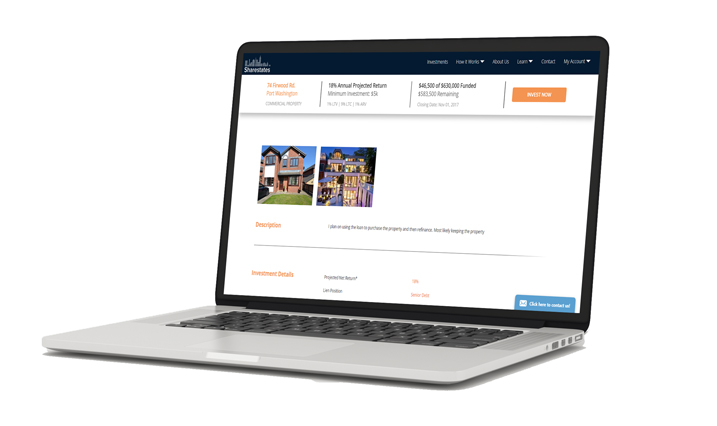

We offer investors direct access to real estate investments through our online marketplace – with net annualized returns between 8-12%. The projects we fund help property owners and developers (aka sponsors) to close deals at a more competitive rate than banks, while allowing them to close deals in a fraction of the time, creating a win-win.

Crowdfunding makes it easy for anyone to build a real estate portfolio and to fund a project. Each of our projects are thoroughly assessed with our 34-point underwriting and risk assessment system – minimizing the risk of all our investment opportunities. Start building your real estate portfolio one share at a time with Sharestates.

How we vet our deals

Automated Prequalification

Property

Underwriting

Risk

Profiling

Research

on Borrower

An investment’s Rating corresponds to its numerical score in its Project Analysis. The Project score is a quantitative method of measuring nine key risk criteria of a real estate investment. Each of the criteria is assessed and assigned a number of points, resulting in a total numerical score ranging from 0 to 25. A Project score of 8-11 will result in an A rating, 13-15 in a B+ rating and so on.

How we determine our annual yields

An investment’s Rating corresponds to a suggested risk adjustment. The gross Sharestates Baseline Interest Rate is 8%, inclusive of origination fees and annual interest rates. Depending on the Investment's Rating, the Investment's Baseline rate will be adjusted accordingly. An Investment Rating of an A should result in a suggested Gross Annual ROI of 8.5%, A B should result in a suggested Gross Annual ROI of 10% and so on.

The Sharestates Redemption Program

While Sharestates investments are relatively short term, we recognize that life has unexpected opportunities and/or surprises that may require liquidity. The Sharestates Redemption Program has been designed to give our investors a liquidity option for those very moments. Now, all Sharestates investors can invest with peace of mind knowing that their principal investment can be accessed when needed. Investors looking to participate in the redemption program just need to email us at redemptions@sharestates.com to access their liquidity on the terms and conditions below.

Click here to see full program terms and restrictions

- DAYS

- PURCHASE PRICE

If extended

- DAYS

- PURCHASE PRICE